Image copyright

Nigel Manton

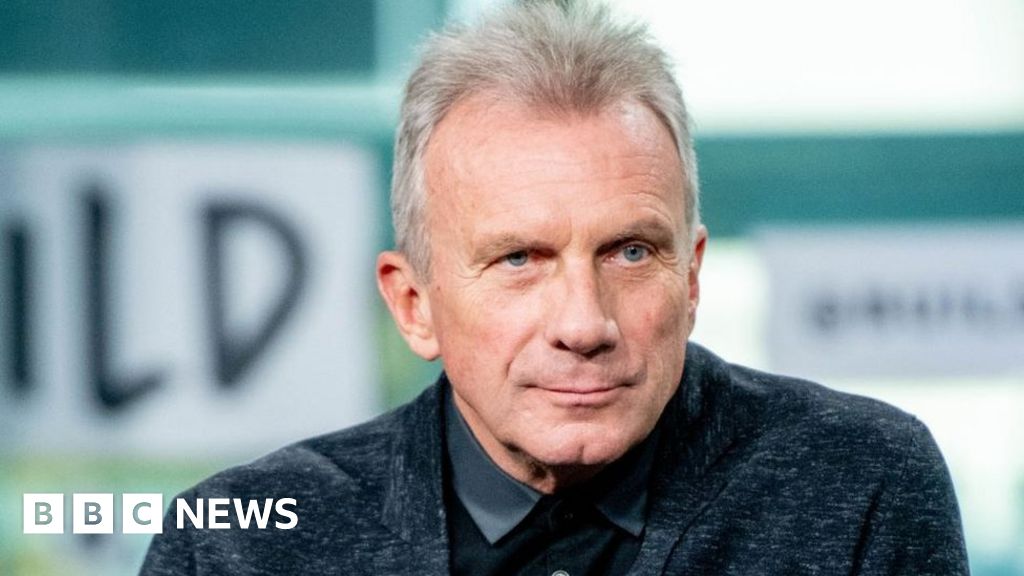

Image caption

Nigel Manton from Cheshire says he spent £10,000 on business interruption insurance for nothing

Image copyright

Nigel Manton

Image caption

Nigel Manton from Cheshire says he spent £10,000 on business interruption insurance for nothing

"It's a bit galling to realise... we've spent more than £10,000 on insurance which wasn't valid," says Nigel Manton, of the Fresh Skin Clinic, in Cheshire.

His firm is one of hundreds that say they were wrongly denied cover for the virus and could go bust as a result.

A court case to decide whether many businesses receive insurance payouts for damage caused to them by the pandemic begins on Monday.

However, insurers say most business policies simply do not cover pandemics.

A judge will decide on the correct interpretation of 17 so-called business interruption policies, but the ruling could affect up to 370,000 firms.

"All businesses thought they'd inoculated themselves by buying this insurance and they have found that this financial vaccine doesn't work," says Mr Manton.

How did we get here?

Following the lockdown, a host of businesses had to close their doors and many looked to insurers to cover their losses through their business interruption policies.

However, many insurers disputed these claims, arguing that such policies were never intended for losses caused by unprecedented measures such as government-imposed lockdowns.

About 400 companies have complained to the financial ombudsman, prompting City regulator the Financial Conduct Authority (FCA) to bring this case.

Image copyright Getty ImagesIt has selected 17 examples from business interruption insurance policies used by 16 insurers, eight of whom were asked to take part in the court case.

These include Hiscox, RSA Group, Arch Insurance, Argenta, Ecclesiastical, MS Amlin, QBE and Zuric, all of whom agreed to take part voluntarily.

The FCA says the case will provide "clarity and certainty for everyone involved in these business interruption disputes, policyholder and insurer alike".

What do affected businesses say?

The views of Mr Manton are echoed by the many businesses who've contacted the BBC over the past few months to express frustration that their business interruption insurance wouldn't pay out.

After all, their business was indeed interrupted by the coronavirus pandemic, as the lockdown stopped them from using their premises, for example.

Now many are crossing their fingers that the results of this case will mean their policies could pay out in future as many are - in the words of the FCA - "under intense financial strain".

Image copyright The Pinnacle Climbing Centre Image caption Simon Ager fears he could incur £200,000 of losses due to lockdownSimon Ager told the BBC his climbing company was at risk of being bankrupted because his insurer Hiscox was refusing to cover losses.

According to his policy, the insurer should cover financial losses for any business unable to use their premises following "an occurrence of any human infectious or human contagious disease, an outbreak of which must be notified to the local authority".

However, citing a separate clause, Hiscox argues that the policy was intended to cover incidents that occur only within a mile of a business

Mr Ager is now part of the Hiscox Action Group, 369 of whose members are owed £47m in uncovered losses. They will give evidence in this week's case and have begun a separate arbitration claim against the insurer.

Richard Leedham, a senior partner at law firm Mishcon de Reya, which represents the group, said: "We can shed additional light on the matter and explain exactly why these policies should pay out and show the damage this refusal is doing to hundreds if not thousands of British businesses."

Image copyright Getty ImagesWhat do the insurers say?

The Association of British Insurers says most business policies do not cover pandemics, as the level of risk involved would make premiums unaffordable. Instead the majority focus on property damage.

Huw Edwards, director general of the ABI, told the BBC: "This is not a debate about whether these policies were intended to cover pandemic, it is a debate as to whether the wordings of these policies inadvertently cover pandemic.

"It is an argument about whether the wording allows insurers to decline the claim."

In June, Hiscox said it recognised businesses faced "extremely difficult times" and was committed to "seeking expedited resolution of any contract dispute".

RSA Group said it continued to "treat claims in line with legal advice, precedent and case law".

The FCA has said the 17 policies under review in the case are only a "representative sample" and that the test case would provide guidance for the interpretation of "many other" business interruption policies.

However, it has also said all along that most small business insurance policies will only focus on property damage and only have basic cover for business interruption.

As such, it believes "in the majority of cases, insurers are not obliged to pay out in relation to the coronavirus pandemic" and this court case will only focus on the "remainder of policies that could be argued to include cover".

The trial is expected to take eight days.

5 years ago

567

5 years ago

567