Media playback is unsupported on your device

The Governor of the Bank of England has backed the government's decision to end its furlough scheme in October.

Andrew Bailey told the BBC it was important that policymakers helped workers "move forward" and not keep them in unproductive jobs.

He said coronavirus would inevitably mean that some jobs became redundant.

The Bank also predicted the economic slump caused by Covid-19 will be less severe than expected, but warned the recovery will also take longer.

More than nine million jobs have been furloughed under the government's job retention scheme, but the Bank expects most people to go back to work as the economy recovers.

Trade unions have urged Chancellor Rishi Sunak to extend the scheme, which pays a share of workers' wages, to avoid mass job losses.

However, Mr Bailey said it was right to focus on helping people to find new jobs.

"It's been a very successful scheme, but he's right to say we have to look forward now," he said. "I don't think we should be locking the economy down in a state that it pre-existed in."

Faster rebound

The Bank said a faster easing of lockdown measures and a "more rapid" pick-up in consumer spending had helped the economy rebound faster than it had assumed in May.

Its latest Monetary Policy Report showed spending on clothing and household goods were back to pre-Covid levels.

However, the Bank warned of a "material" rise in unemployment this year as it held interest rates at 0.1%.

Mr Bailey said recent data suggested the recovery in consumer spending was gaining traction, while spending on food and energy bills remained above pre-Covid levels.

He said: "We have had a strong recovery in the last few months. The pace puts the economy ahead of where we thought it would be in May."

However, Mr Bailey cautioned against reading too much into recent figures: "We don't think the recent past is necessarily a good guide to the immediate future," he said.

The Bank said spending on leisure and entertainment, which accounts for a fifth of all consumer spending, remained subdued.

Business investment was also weak, which would weigh on the recovery.

Slower recovery

The Bank expects the UK economy to shrink by 9.5% this year.

While this would be the biggest annual decline in 100 years, it is not as steep as its initial estimate of a 14% contraction.

The Bank said the UK still faced its sharpest recession on record, with the outlook for growth now "unusually uncertain".

Mr Bailey said it was the "largest quantum of uncertainty in a forecast" that policymakers had ever published.

The Bank expects the UK economy to grow by 9% in 2021, and 3.5% in 2022, with the economy forecast to get back to its pre-Covid size at the end of 2021.

This compares with growth estimates of 15% and 3% respectively, in a scenario the Bank set out in May.

Unemployment is expected to almost double from the current rate of 3.9% to 7.5% by the end of the year as government-funded support schemes come to an end.

Average earnings are also expected to shrink for the first time since the financial crisis.

The Bank said more workers faced a pay cut or freeze in 2020, adding: "In many cases, bonuses have been scaled back or withdrawn altogether for this year."

Its latest forecasts are based on the assumption that there is no second wave of the virus and that there is a smooth transition to a new EU free trade agreement at the start of 2021.

Meanwhile, a fall in energy prices and the temporary VAT cut for hotels, theme parks and other hospitality businesses means the cost of living is expected to barely rise this year.

The Bank expects inflation, as measured by the consumer prices index (CPI), to fall close to zero by the end of 2020, before gradually rising back to its target of 2%.

Negative rates 'under review'

The Monetary Policy Committee (MPC) said it would not even think about raising interest rates until there was "clear evidence" the recovery had taken hold.

Mr Bailey also signalled that policymakers were against using negative interest rates any time soon, adding that such a move may have unintended consequences.

It could stop the UK's already fragile banks from lending, or lead to customers withdrawing their money and holding it in cash.

Policymakers also noted that High Street banks would find it difficult to cut savings rates below zero.

"They are part of our toolbox," said Mr Bailey. "But at the moment we do not have a plan to use them."

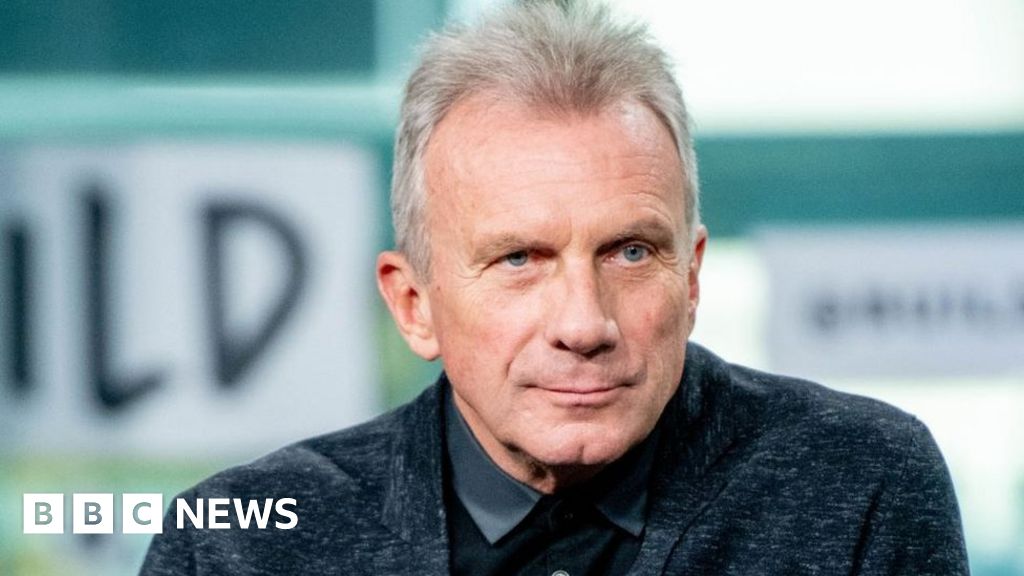

Image copyright Getty ImagesHe said the public may find the policy difficult to understand. "There would be a lot of explaining to do on what this means, why we're doing it, and what the benefits would be."

Ruth Gregory, an economist at Capital Economics, said the Bank was likely to increase its money printing programme by a further £100bn later this year.

She also expects the Bank to keep interest rates at 0.1% "or below" for "at least five years".

Are banks passing rate cuts on?

Millions of households that already had a variable-rate mortgage have benefitted from recent interest rate cuts.

However, the Bank said borrowing had become more expensive over the past six months for first-time buyers and others moving up the property ladder, particularly for people with small deposits.

Banks also continued to reduce rates on savings accounts. The average instant-access savings account now pays 0.1% annual interest, compared with 0.4% in February.

Lenders said they were restricting credit due to the uncertain economic outlook.

One in six mortgages in the UK is currently subject to a payment holiday because of the pandemic.

The economic damage may have been been less catastrophic than feared in recent months, but the Bank thinks the scars will remain for longer, both to activity and jobs.

The Bank believes it will take the economy until the end of 2021 to get back to pre-crisis activity. Crucially it admits the risks are to the downside - not least as it assumes that the health risks from the virus and restrictions gradually recede, with no significant resumption of a widespread lockdown. That could prove a serious setback.

What then? The key to our recovery is consumer spending - and the interest rates that might shape that are at record lows already. Could we be heading into the uncharted territory of negative rates, where savers are effectively charged to deposit cash? It seems unlikely. The Bank has been taking a closer look at that tool and concludes it could be "less effective ...to stimulate the economy".

It does have other tools - the Bank has supported cashflow across the economy by pumping funds into financial markets via quantitative easing and participating in some loan schemes.

But it may have to rely increasingly on the chancellor to give the economy emergency aid in the event of further trouble.

5 years ago

660

5 years ago

660